Contents:

Project managers can use the resulting information to identify potential cost savings and make adjustments to the project budget on the go. While working on a project, you can use project accounting to get accurate and up-to-date information about the financial status of your ongoing project. The main difference between project accounting and management accounting is the focus of the two disciplines. Having a clear picture of the finances helps project managers ensure that the project stays within budget. Project accounting is a process that involves keeping track of the finances of a project and using that information to manage that project effectively. Simply put, it’s a special form of accounting that is used to track the financial progress of a certain project.

Replicon’s platform is designed to ensure easy integration with the existing ecosystem in any organization. Easily share project financial information with the relevant solutions such as payroll and billing in a few clicks, reducing administrative overheads and streamlining downstream processes. Replicon offers turnkey cloud-based integrations to enable faster deployment, integration and upgrade. You also have access to pre-built integrations with all the major solution providers. For those with legacy systems, Replicon can create custom integrations to solve data sharing challenges across the organization’s ecosystem. Replicon gives you the ability to configure and customize timesheets to capture the exact details that you need for your project accounting requirements.

Summarizing What is Project Accounting and How to Optimize It

Project accounting implementation is most common in contract-based businesses, like construction or engineering firms. Project accounting is a great way to track progress and day-to-day finances for an individual project. Take advantage of that oversight by running frequent reports to monitor financial health and recognize potential issues before they slow you down.

Since you can’t figure out where you made the money with a profit and loss statement, you need some other form of accounting to help figure this out. While the profit and loss statement is pretty straightforward and easy to understand, it doesn’t tell you how your firm made its money. General accounting consists of two methodologies that must be chosen between.

Here are the main reasons why you should use project accounting for your next project. Every project depends heavily on resources, including time, labor, and materials. For project accounting, knowing how to allocate and consume these resources is essential to tracking whether your budget is within your established parameters. After every project category is completed, conduct an in-depth budget analysis to address budget overruns and reallocate money if necessary.

You can view the financial results of the project costs, revenues, and profits. You can view over/under billing, and over/under costs, as well as revenues. You can also track interim financial results and IFRS WIP balances. Unfortunately, the problem many companies are still dealing with is static numbers.

Doing the preliminary budget analysis, you’d most likely benefit from insights you have from previous projects you estimated and monitored. If there’s limited information regarding the project, analogous estimation is a workaround. Everything you need to know about project accounting, presented by Replicon, the Time Intelligence® platform. Easy-to-use technology that grows with you and helps increase productivity and profitability.

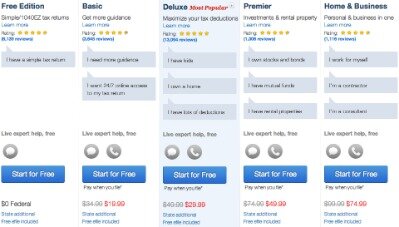

In either case, solving the problem requires spending more money and will slow down the work. We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites. QuickBooks Online Advanced, project accounting is more streamlined and easier than ever. How to set up projects in QuickBooks to get the most out of your software.

Completed Contract

Monitoring these costs helps in ensuring that the numbers are within the expected budget parameters. To prevent cost overruns, it is vital that all costs around time, materials and labor are accounted for even before the project starts. It is also crucial to take into account additional costs that are not immediately recognizable.

Essentially it’s the money an organization makes from each project, when costs are deducted from the revenue. Time & material projects are ongoing—there’s no set end date, and they’re meant to be completed over a period of months or years. They’re billed by hour, and they require active day-to-day management. Clockify is a time tracker and timesheet app that lets you track work hours across projects. Time estimation in project management guide Improve your time estimation in project management with our guide…. You can go through popular options and create a list of the ones with the features you need.

Why Use Project Accounting

Unlike business accounting, where you reconcile transactions and revenue every month, quarter or year, project accounting must have a hands-on approach. By tracking and calculating real-time costs, it’s easier to know how the project is progressing, how much money you’ve spent, and where is the best place to allocate any remaining budget. We’ve talked about this already throughout this guide, but tracking time and costs in real-time is crucial to project management accounting. Instilling a proper accounting project management plan can have a lot of upside for your business’s bottom line. Not only does it give you an oversight of every project in your pipeline, but it can also keep track of billable and non-billable hours.

4 day Course: Mastering International Financial Reporting … – GlobeNewswire

4 day Course: Mastering International Financial Reporting ….

Posted: Fri, 21 Apr 2023 13:03:36 GMT [source]

Project accounting is the practice of quantifying the performance of project-based activity. For projects relying primarily on human capital, this typically involves tracking time, expenses, budgets, bill rates and other financial metrics that reveal the performance of a project. Your EAC offers an informed view of where a project is likely to end up if executed to plan. EAC combines cost and revenues to date with your projections of scheduled work.

How to use project accounting

They should also notify project managers when they complete their work or will use additional hours to complete it, exceeding the budget. Using an engaging project accounting software such as Runn brings insights to life, and makes crucial data visible. This data can easily get lost in a spreadsheet, where all information looks the same. However, dedicated project accounting software is engaging and automated, empowering real-time decision making without requiring hours of work. But project accounting is also a great tool for improving profitability, saving money, and meeting deadlines. You can use it to identify inefficiencies, cut costs, and improve productivity.

You separated your budget into categories in the budget phase—now it’s time to break the project down even further. When the execution phase begins, each team member will work on project tasks within their assigned category. The budget set for that category should then be allocated toward each task.

Hyperion JV Wins Approval For Boynton Beach Mixed-Use Project – The Real Deal

Hyperion JV Wins Approval For Boynton Beach Mixed-Use Project.

Posted: Fri, 21 Apr 2023 13:45:00 GMT [source]

Cross charging occurs when resources are shared to work on a project in a different department, cost center or subsidiary. Some staff may be charging codes and departments outside of their normal ones on their timesheets, and their managers may not see their coding. The project’s accountant must keep a close eye on these hours billed. This way, the project manager has a handle on the project’s total billed hours.

The ultimate guide to accounting project management

It can also end up as a default method when others, such as the percentage of completion method, fail due to lack of clarity. Project accounting and more general financial accounting share many things in common but they’re not the same thing. Yes, they both deal with costs and expenses, but the context and the execution differ enough to make it worth exploring some of those differences. Manage and assign resources based on each project’s specific needs. Understand how consulting firms and professional services teams discuss their business.

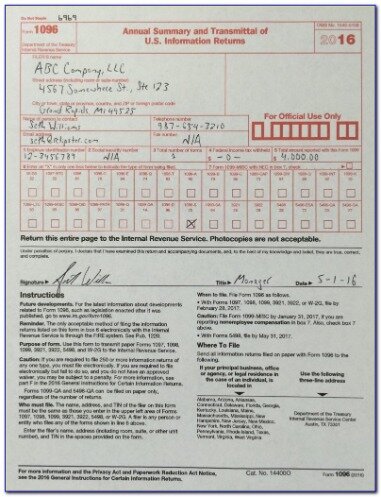

If full charge bookkeeperrs or stakeholders want to know how the project is progressing, the project accountant should be able to tell them. When the project wraps up, you’ll close the accounts, transfer sub-ledger information to the general ledger, and submit any relevant tax paperwork to state and federal agencies. Big projects like revising the org chart or simplifying the time-card system may lead to more profits eventually, but they’re not money-makers in themselves.

- There are a variety of costs and billing rates based on services provided, expertise, location, etc.

- A specialized form of project accounting, production accounting, is used by production studios to track an individual movie or television episode’s costs.

- Vary billing rates by employee / customer, type of work, or specific project.

- Be that as it may, there are some best practices around project accounting to be aware of.

- Self-Employed The tools and resources you need to run your own business with confidence.

Project Management Keep your projects on track and deliver bottom-line benefits. Financial Management Boost profitability, strengthen margins and enable real-time financial oversight. As Cyleron’s Chief Technology Officer Todd Rebner explained to Forbes, scope creep is undoubtedly the most common reason tech development projects fail.

You can use these granular details to navigate material, labor, and time challenges. Project accounting is a way to track the costs of each individual deliverable over the course of a project’s lifecycle. It involves elements of financial and management accounting that allow you, as the project manager, to monitor a project’s financial health and profit margin. Another advantage of Accounting Seed is that it makes it easier to track and generate financial reports and paperwork.

While this non-billable work is not reimbursable by clients, it is still important to keep track of time spent on these projects. Non-billable time can be considered a cost center for the business as opposed to a profit center when completing billable client work. Being able to minimize changes to the overall project roadmap will help to keep costs down.

These are assets that have been exhausted during the course of a project or time period. Blog Get insights into the latest professional services news, tips and tricks. If you are in danger of going over budget, you’ll likely know by the end of the day instead of waiting until you crunch the numbers at the end of the project. ” misrepresent how much an item costs or how it’s being used,” said Bernovski. “Open, honest and direct communication can usually remedy a potential situation like this one.”

As well as that, they can track the progress of projects in real time, and make informed decisions based on up to date financial data. Once you determine what features you need from a project management software for accountants, project managers, and business owners, it’s time to look into the quality of said features. Luckily, the internet offers plenty of ways to make sure that you make the right choice.

- Since small businesses need the flexibility that mobile apps provide, the solution should have robust mobile capabilities.

- With Accounting Seed, accounting data is automatically pulled into customizable financial reports in real time, so you’re always up to date on where money is being spent.

- According to Project Management Institute, the scope of the project manager’s job is expanding.

- Our collaborative platform helps you work better together, no matter where, when or what department.

For freelancers and SMEs in the UK & Ireland, Debitoor adheres to all UK & Irish invoicing and accounting requirements and is approved by UK & Irish accountants. Start invoicing with SumUp today and gain access to additional tools to run your business. A payment model where a company or individual requests payment for work to be completed in the future.

The method ensures that the company meets the overall project financial goals through close monitoring of project costs, material expenses, billing and revenue. Standard business accounting tallies expenses, revenues and budgets across an organization. Business-as-usual accounting focuses on revenue and expenses by department and looks at the revenue stream. The project accounting methods are the same whether they are for business-as-usual or specific projects and whether accountants use an accrual, cash-basis or some hybrid accounting method. Accountants have a wide variety of calculations to choose from to meet the methodological requirements. Any deviations from the project plan affect the project’s bottom line.

These expenses could include receipts, invoices, and other documents that show how much you’re spending and earning. Be sure to update your records regularly, and compare them to your original budget to see how you’re doing. Once the project begins, the project’s progress and budget have to be monitored closely. The information collected from accounting is then used to ensure that the project stays on budget. Consider adding a 10 percent cushion against unforeseen costs, like supply price increases.