Contents

Any information may be prone to shortcomings, defects or inaccuracies due to technical reasons. Certain information on Website may be on the basis of our own appraisal of the applicable facts, law and regulations in force at the date hereof. You acknowledge that the Website does not pre-screen content, but that the Website will have the right https://1investing.in/ in their sole discretion to refuse, edit, move or remove any content that is available via the facilities. You agree not to use the facilities for illegal purposes or for the transmission of material that is unlawful, harassing, libelous , invasive of another’s privacy, abusive, threatening, or obscene, or that infringes the rights of others.

In a triangle chart pattern, the direction of break might be in the direction of the prevailing trend. • The symmetrical triangle patterns are characterized by both rising support trend line and a falling resistance trend line. • The symmetrical triangle, which can also be referred to as a coil, usually forms during a trend as a continuation pattern.

Here, the lower trendline is horizontal, joining the near-identical lows. The upper trendline meets the lower trendline through its diagonal inclination to form an apex. Trade can be initiated once the breakdown of the horizontal line is confirmed. Volume and other indicators should be considered as factors to confirm the breakdown before entering the trade. It is formed by two trendlines – a horizontal line that connects with the swing highs and a slanted line that connects with the higher lows. This forms a bullish pattern, and it can be generated in any market condition.

Technical Classroom: How to trade using triangle chart patterns

The breakout in an ascending triangle can occur to the upside or downside. Ascending triangles are often called continuation patterns since the price will typically breakout in the same direction as the trend that was in place just prior to the triangle forming. Information on this Website sourced from experts or third party stock service providers, which may also include reference to any ABCL Affiliate. However, any such information shall not be construed to represent that they belong or represent or are endorsed by the views of the Facilities Provider or ABC Companies. Any information provided or sourced from ABCL Affiliate belongs to them.

Please verify with scheme information document before making any investment. Either party can terminate this Agreement by notifying the other party in writing. Upon such termination You will not be able to use the facilities of this Website. These Terms of Use, as the same may be amended from time to time, will prevail over any subsequent oral communications between you and the Website and/or the processor bank. The information provided on or through the Website is for general guidance and information purposes only and they do not in any manner indicate any assurance or opinion of any manner whatsoever.

- Technical/Fundamental Analysis Charts & Tools provided for research purpose.

- These charts are the underpinnings of a well-calculated move when it comes to the assessment of risk and reward ratios.

- Please also read the Privacy Policy for more information and details as provided on the Website.

Once you have created ONE ID you can link and view all your financial products held with ABC Companies on single web page through verification / authentication procedure as applicable to your account/financial products held with the respective ABC Companies. You have the option to withdraw the said consent in the manner specified under these Terms of Use. Please also read the Privacy Policy for more information and details as provided on the Website. Changes will be effective upon posting of the revised Privacy Policy on the Website. The stop loss would go below the new support area, and the profit target would remain the same as in the first example – the length of the back of the triangle. The second approach is to “wait for the price to break out of the triangle” , as in the first example, and then look to place a buy order on the retest of the previous support line .

What are traders looking to benefit from when a stock crosses the line, or makes a breakout? Well the breakout point gives them a clear picture of where to place their next move – an ascending triangle pattern gives them a good idea of what trading move to make . It also gives them an inkling about where to place their entry point , their profit goal and their stop loss. This continuation makes the pattern significant no matter if it’s an uptrend or a downtrend. Based on the price breakout, there is a good chance the investors will trade the securities aggressively. You can easily notice the breakout as it will suggest high interest.

Start Your Financial Learning Journey

A waiver on any one occasion shall not be construed as a bar or waiver of any rights or remedies on future occasions. However there is no conflict on these services and commissions if any payable are in accordance of the extant regulations. You may receive e-mails /communications/notifications from the Third Party Services Providers regarding facilities updates, information/promotional e-mails/SMS and/or update on new product announcements/services in such mode as permitted under law.

You agree that the Facilities Provider/ ABC Companies will not be liable to you in any manner whatsoever for any modification or discontinuance of the facilities. We may suspend the operation of this Website for support or maintenance work, in order to update the content or for any other reason. This Website may be linked to other websites on the World Wide Web that are not under the control of or maintained by ABCL. Such links do not indicate any responsibility or endorsement on our part for the external website concerned, its contents or the links displayed on it. These links are provided only as a convenience, in order to help you find relevant websites, facilities and/or products that may be of interest to you, quickly and easily. It is your responsibility to decide whether any facilities and/or products available through any of these websites are suitable for your purposes.

Predictions and analysis

Traders are best off using various tools for technical analysis to reconfirm their predictions. Beginner traders might also do well to hire experts to give them advice on potential stock price movements. The facilities on the Website are not intended to provide any legal, tax or financial or securities related advice. You agree and understand that the Website is not and shall never be construed as a financial planner, financial intermediary, investment advisor, broker or tax advisor. The facilities are intended only to assist you in your money needs and decision-making and is broad and general in scope.

Symmetrical triangle does not give any clue to the direction of breakout. Technical analysts always prefer to assume that the breakout will be in the direction of the trend if it is not matured, otherwise, it can be considered as a reversal. The lower line of the descending triangle acts as a support line and the upper line acts as a resistance line. The distance between the triangle pattern will range from weeks to months.

They help indicate the continuation of a bullish and bearish market. While there are instances when symmetrical triangles mark important trend reversals, they more often mark a continuation of the current trend. Regardless of the nature of the pattern, continuation or reversal, the direction of the next major move can only be determined after a valid breakout. A trader buying stock upon witnessing a breakout from an ascending triangle pattern will usually place his stop loss just below the lower leg of the triangle. I bet you’re wondering why I’m telling you a story about traffic police SOPs in the days gone by. Well, very simply because just like the policemen watch for a driver who cannot walk along the line, in using the ascending triangle pattern too, traders are trying to identify places where the stock wavers from lines drawn on a stock graph.

Be In Charge of Your Financial Destiny

H – pattern’s height (distance between support and resistance lines at pattern’s origin). When the price breaks above the resistance line , usually somewhere between halfway and three-quarters of the way through the pattern, a buy signal is received. These Terms of Use and any notices or other communications regarding the Facilities may be provided to you electronically, and you agree to receive communications from the Website in electronic form. Electronic communications may be posted on the Website and/or delivered to your registered email address, mobile phones etc either by Facilities Provider or ABC Companies with whom the services are availed.

Ascending and Descending Triangle Patterns

The inverted image of an ascending triangle is known as a descending triangle. When the upside breakout happens, there will be an increase of volume after the breakout. At least two lows are needed to make the lower ascending trend line.

Please be aware of the risk’s involved in trading & seek independent advice, if necessary. The Facilities Provider, ABC Companies or any of its third party service providers and processor bank/merchants etc. shall not be deemed to have waived any of its/their rights or remedies hereunder, unless such waiver is in writing. No delay or omission on the part of Facilities Providers and ABC Companies, in exercising any rights or remedies shall operate as a waiver of such rights or remedies or any other rights or remedies.

Always be aware of the trend direction before the consolidation period. Pay 20% or “var + elm” whichever is higher as upfront margin of the transaction value to trade in cash market segment. We will be happy to have you on board as a blogger, if you have the knack for writing. Just drop in a mail at with a brief bio and we will get in touch with you.

Ascending and Descending Triangle Patterns in Investar Software

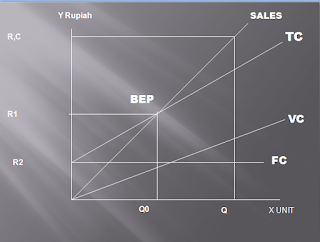

Triangle patterns are important because they help indicate the continuation of a bullish or bearish market. Usually with a triangle pattern, the price consolidation period consists of higher lows and lower high, forming the shape of a “triangle” when the resistance and support lines converge towards each other. Traders usually anticipate the stock price to move in the same direction that the stock graph had mapped before the triangle.